Starting a business comes with a number of choices, including whether to fund the business with your own money, take the slower path to success, or involve investors early at the expense of equity.

My choice was to invest as much of my own cash as I could, so I needed to ensure other aspects of my life supported this choice. For this reason, my wife and I decided to continue renting rather than buying a house, so I had less debt and more capital to fund our start-up.

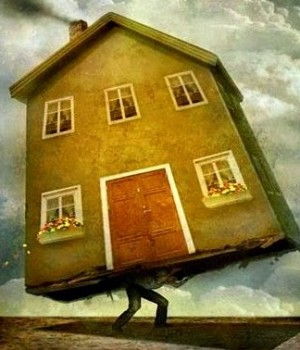

This decision was also based on a wider belief that Australia’s culture of home ownership is stifling entrepreneurship. A large proportion of the population’s money is tied up in bricks and mortar, often for decades, instead of being available to back ideas and innovation.

It’s a situation that’s come about largely as a result of parental guidance, with the cheaper housing market of previous generations creating a mentality of home ownership that is less realistic today.

However, millennials are fast realising that times are changing, and the same parental guidance is no longer relevant when it comes to housing in the current landscape.

What is the cost of housing in Australia today?

Recent statistics show that Australia has the second least affordable housing in the world, after Hong Kong. According to the ABS Survey of Income and Housing, 10 per cent of home buyers in 1982 spent more than 30 per cent of their gross household income on housing costs. This is compared to 2011, nearly thirty years later, where this figure had doubled to 21 per cent of all home buyers.

Parents often tell you to get a job, sign your life away with a thirty-year mortgage, and work for the rest of your life to repay your bank debt. And while it’s a situation that works very nicely for the banks, you’re likely to spend the rest of your life making all your life choices around this huge financial commitment… and this is exactly why we shouldn’t listen to them.

Too many talented graduates prioritise getting a steady job so they can get onto the housing ladder. They put all their savings towards a mortgage deposit rather than funding their business ideas, and become trapped in a corporate job. Employees hesitate to take the risk of quitting their job to follow their dream, because they’re concerned about the repercussions should they not be able to meet their mortgage payments.

And it’s a particularly Australian problem

In many countries, such as the UK and USA, renting isn’t taboo like it is in Australia. No one expects to be able to buy in central London or in the San Francisco marina district, so they rent and live closer to other entrepreneurs and innovators rather than miles out.

In the end, if you can use your own resources to bootstrap your venture, you can retain full ownership and reap the full rewards as your business builds and begins to flourish. It may just be a matter of saying no to Australia’s home ownership obsession, and yes to a lifestyle choice that could allow you to live your dreams.

It’s almost a no-brainer!

Clayton Howes is the CEO of digital consumer finance firm MoneyMe. He’s an expert in personal finance as well as small business and start-ups.

![Instagram for Business… in 12 steps [FREE INFOGRAPHIC]](https://anthillonline.com/wp-content/uploads/2015/08/Capture7-300x194.jpg)

![The Top 5 Most Insanely Dumb Mistakes made by Rookie and Seasoned LinkedIn Users, with David Hobson [FREE REPORT]](https://anthillonline.com/wp-content/uploads/2015/07/Screen-Shot-2015-11-26-at-14.29.18-100x75.png)

![How to pitch sales and marketing ideas to your boss with James Tuckerman [FREE REPORT]](https://anthillonline.com/wp-content/uploads/2015/07/Render-3-100x75.png)

![How To Grow Your Business and Profits with Jason Cunningham [CHEAT SHEET]](https://anthillonline.com/wp-content/uploads/2015/07/Cunningham-100x75.png)

![Want more credibility and influence? Unlock the 12 principles of persuasion checklist [FREE DOWNLOAD]](https://anthillonline.com/wp-content/uploads/2016/03/james-persuasion-and-influence-nfsu-02.pdf-Box-2016-03-24-15-09-44-100x75.png)

![How to confidently raise venture capital… with Jack Delosa [CHEAT SHEET]](https://anthillonline.com/wp-content/uploads/2016/04/jack-de-losa-confidently-raising-venture-NFSU-rebrand-01.pdf-Box-2016-04-19-12-37-42-100x75.png)

![Now that’s a boat! [VIDEO]](https://anthillonline.com/wp-content/uploads/2012/10/venus-300x317.jpg)

![Three things a dog, a puddle and small boy can teach every entrepreneur [VIDEO]](https://anthillonline.com/wp-content/uploads/2013/01/dogboypuddle-300x337.jpg)

![I can’t believe we waited so long for this: Gmail Blue [VIDEO]](https://anthillonline.com/wp-content/uploads/2013/04/BlueManGroup-300x350.jpg)

![5 Ways to get more out of your coffee shop meetings with Antony Gaddie [CHEAT SHEET]](https://anthillonline.com/wp-content/uploads/2015/07/gaddie-3d-cover-01--100x75.png)

![How did Sean Clark build a $300 million turnover company from a $500 AdWords investment? [CHEAT SHEET]](https://anthillonline.com/wp-content/uploads/2016/03/SEAN-CLARK-cheatsheet-NSFU-02.pdf-Box-2016-03-16-14-43-21-100x75.png)

![How to expand into New Markets with Elsita Meyer-Brandt [CHEAT SHEET]](https://anthillonline.com/wp-content/uploads/2015/07/Screen-Shot-2015-11-26-at-15.52.30-100x75.png)

![Learn how to use Instagram as a business tool [FREE INFOGRAPHIC]](https://anthillonline.com/wp-content/uploads/2012/12/nickelbackinstagram-100x75.jpg)

![New Zealand’s Xero eyes US IPO, further disruption as subscribers increase [INFOGRAPHIC]](https://anthillonline.com/wp-content/uploads/2014/07/sruuuuujana-212x194.png)

![Ever wonder if your ‘content marketing’ is really just crap? You gotta see this! [INFOGRAPHIC]](https://anthillonline.com/wp-content/uploads/2014/08/content-100x75.jpg)

![7 Business Lessons From Game of Thrones [INFOGRAPHIC]](https://anthillonline.com/wp-content/uploads/2014/10/infographic-games-of-thrones-041-100x75.jpg)

![How to build your own Media Empire… In seven steps with Nathan Chan [INFOGRAPHIC]](https://anthillonline.com/wp-content/uploads/2014/10/Nathan-Chan-Infographic-e1413419529176-100x75.jpg)

![5 Business Lessons From Tinder [INFOGRAPHIC]](https://anthillonline.com/wp-content/uploads/2014/10/Tinder-Elegant-Infographic-100x75.jpg)