Equity crowdfunding platform OurCrowd has raised AUD$1.5 million for private Australian mobile health tech company Global Kinetics Corporation (GKC), as part of its recent AUD$14.8 million capital raise, making it one of the largest equity crowdfunding deals Australia has seen so far.

Launched in 2007, GKC is commercialising its Parkinson’s KinetiGraph (PKG) which helps clinicians assess and manage the key disabling symptoms of Parkinson’s disease and other movement disorders.

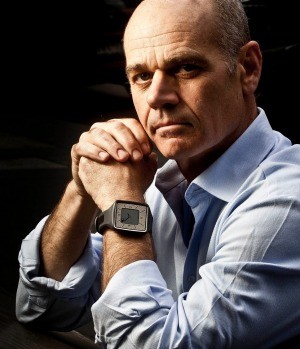

GKC Managing Director, Andrew Maxwell (pictured sporting the latest version of the PKG on his wrist) said the capital raised will be used to implement its strategic North American expansion, following recent FDA clearance.

The company also already has CE Mark and TGA registration and the PKG technology, which was co-developed by Professor Malcolm Horne and Dr. Rob Griffiths at the Florey Institute of Neuroscience and Mental Health, is already in use at more than 100 specialty movement disorder clinics world over.

This is another big step for equity crowdfunding

Andrew also highlighted that the successful closing this important funding round for his company demonstrates that equity crowdfunding is a viable platform for Australian start-ups and early stage companies looking to secure critical investment capital.

He said the OurCrowd investment was an important component of their recent capital raising along with existing investors (including Brandon Capital Partners), institutional investors, experienced industry veteran investors, staff and high net worth individuals.

On why GKC chose to raise capital from OurCrowd in particular, Andrew told Anthill that it provided an opportunity to speak to one capital source but reach many investors.

“The investor group that invest on the OurCrowd platform are experienced, sophisticated and global and provide a value added network of advocates for GKC,” he said. “We are impressed by the high calibre investors to whom OurCrowd has exposed our company.”

This $1.5 million investment from OurCrowd puts GKC among 68 start-ups around the world that have already accessed the far-reaching platform’s investment pool, which includes more than 8,000 accredited/sophisticated investors in 120 countries.

OurCrowd’s Australian Managing Director, Dan Bennett said they are delighted to be investing, together with their community in innovative Australian tech. “GKC is already making a huge difference in the lives of the sufferers of Parkinson’s disease,” he remarked.

What else has OurCrowd achieved so far?

OurCrowd started operating in Australia in February 2014, and has since raised more than $25 million from Australian investors into local and global deals, enabling them to invest alongside some of the world’s most prominent angels and venture capitalists such as Eric Schmidt and Peter Theil.

Globally, OurCrowd has raised more than $150 million in just over two years of operation, demonstrating how well equity crowdfunding can complement and even lead traditional funding sources, such as venture capital.

Founded by serial entrepreneur Jon Medved, the platform is designed exclusively for sophisticated (accredited) investors that wish to invest in early stage companies. OurCrowd investors must meet stringent accreditation criteria and invest a minimum of $10,000 per deal of their choice.

The company has a highly selective deal flow, using its extensive network to proactively identify and pursue companies for targeted investments. Once identified, OurCrowd invests its own capital in every deal and on the same terms as its investors.

It also takes an active role in providing professional guidance and support to the founders, through both board participation and by assigning a mentor with relevant expertise to guide the company.

As far as what it takes for a start-up out there to attract OurCrowd funding like GKC has done, Dan told Anthill, “We are always on the lookout for high quality entrepreneurs that understand what it takes to scale a business in the tech space.”

“If they are a serial entrepreneur that is even more compelling for the business given we believe success if often down to ability to execute,” he added.

“OurCrowd is also looking for businesses that already benefit from some proof of concept around product and market fit.”

![5 Ways to get more out of your coffee shop meetings with Antony Gaddie [CHEAT SHEET]](https://anthillonline.com/wp-content/uploads/2015/07/gaddie-3d-cover-01--300x194.png)

![Seven steps to crafting the perfect email, with James Tuckerman [FREE REPORT]](https://anthillonline.com/wp-content/uploads/2015/08/7-steps-cheatsheet-3d-cover-nuova--100x75.png)

![Four Page Digital Marketing Strategy [FREE RESOURCE]](https://anthillonline.com/wp-content/uploads/2015/01/FOUR-PAGE-IMAGE-100x75.png)

![Seven essential steps to a successful podcast with Loren Bartley [Cheat Sheet]](https://anthillonline.com/wp-content/uploads/2015/11/Screen-Shot-2015-11-26-at-11.21.58-100x75.png)

![The Top 5 Most Insanely Dumb Mistakes made by Rookie and Seasoned LinkedIn Users, with David Hobson [FREE REPORT]](https://anthillonline.com/wp-content/uploads/2015/07/Screen-Shot-2015-11-26-at-14.29.18-100x75.png)

![How to give good headlines, and create emails that get opened [CHEAT SHEET]](https://anthillonline.com/wp-content/uploads/2013/11/7-steps-cheatsheet-3d-cover-nuova--100x75.png)

![What does Google’s latest algorithm update mean for your website? [VIDEO]](https://anthillonline.com/wp-content/uploads/2015/04/google-mobile-smartphone-search-300x350.jpg)

![Self confidence: it’s an essential skill for everyone but, especially entrepreneurs [VIDEO]](https://anthillonline.com/wp-content/uploads/2013/10/IvanJoseph-300x350.jpg)

![Five essential things to get right if you want to raise capital, with Bryan Vadas [FREE CHEAT SHEET]](https://anthillonline.com/wp-content/uploads/2015/08/vadas-3d-cover-01--300x194.png)

![Learn how to devise winning business ideas in four steps with Martin Martinez [CHEAT SHEET]](https://anthillonline.com/wp-content/uploads/2015/07/Screen-Shot-2015-11-26-at-13.44.27-100x75.png)

![Need more leads? Here are five strategies [FREE DOWNLOAD]](https://anthillonline.com/wp-content/uploads/2016/04/james-FIVE-SIMPLE-STRATEGIES-TO-GET-MORE-LEADS-01-06.pdf-Box-2016-05-13-15-49-32-100x75.png)

![How Master the Art of Sales Even if it Makes You Feel All Weird and Icky Inside with Phil Anderson [CHEAT SHEET]](https://anthillonline.com/wp-content/uploads/2015/08/PHIL-ANDERSON-COVER-100x75.png)

![The Ultimate Social Media Almanac with James Tuckerman [Cheat Sheet]](https://anthillonline.com/wp-content/uploads/2015/11/Screen-Shot-2015-11-26-at-11.24.55-100x75.png)

![New Zealand’s Xero eyes US IPO, further disruption as subscribers increase [INFOGRAPHIC]](https://anthillonline.com/wp-content/uploads/2014/07/sruuuuujana-212x194.png)

![Ever wonder if your ‘content marketing’ is really just crap? You gotta see this! [INFOGRAPHIC]](https://anthillonline.com/wp-content/uploads/2014/08/content-100x75.jpg)

![7 Business Lessons From Game of Thrones [INFOGRAPHIC]](https://anthillonline.com/wp-content/uploads/2014/10/infographic-games-of-thrones-041-100x75.jpg)

![How to build your own Media Empire… In seven steps with Nathan Chan [INFOGRAPHIC]](https://anthillonline.com/wp-content/uploads/2014/10/Nathan-Chan-Infographic-e1413419529176-100x75.jpg)

![5 Business Lessons From Tinder [INFOGRAPHIC]](https://anthillonline.com/wp-content/uploads/2014/10/Tinder-Elegant-Infographic-100x75.jpg)