This SMART 100 profile and the information it contains is a duplication of content submitted by the applicant during the entry process. As a function of entry, applicants were required to declare that all details are factually correct, do not infringe on another’s intellectual property and are not unlawful, threatening, defamatory, invasive of privacy, obscene, or otherwise objectionable. Some profiles have been edited for reasons of space and clarity.

Learn more about the SMART 100 >>

1. THE BEGINNING

This innovation initially came to life when…

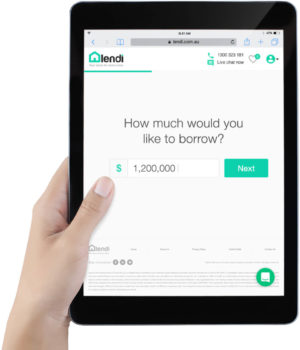

Our Home Loan Specialist, developer and UX teams worked together to deliver a more sophisticated and enjoyable experience for Australian home loan customers. It is the next step in our quest to use technology to transform the home loan experience from being cumbersome, manual and stressful to one that is transparent, streamlined and efficient. The Lendi Customer Dashboard empowers customers by providing 24/7 access to up to date information on the status of their loan, next steps and where to get help if they need it.

2. WHAT & HOW

The purpose of this innovation is to…

…reduce customer stress and improve efficiency by giving customers more clarity, control and visibility over the home loan process from application through to settlement.

It does this by…

…taking what is a traditionally a convoluted and unstructured offline process and succinctly capturing information from multiple touch points in an easy to use customer interface that is accessible by desktop or mobile.

3. PURPOSE & BENEFITS

This innovation improves on what came before because…

It provides Lendi customers with an authenticated user view of their history and clearly outlines the status of and next steps in their individual loan application and settlement journey.

Its various benefits to the customer/end-user include…

Saving time and reducing the anxiety or stress often associated with getting a home loan by giving customers more control and visibility.

4. COMPETITIVE LANDSCAPE

In the past, this problem was solved by…

Nobody. Home loan borrowers reported feeling blindfolded or in the dark about the process and the status of their applications. With no way to accurately capture information, summarise history or indicate the next steps in the process, numerous phone calls and emails were required to check on the status of applications and find out next steps.

The manual processing of paperwork, email trails and phone calls by loan customers of the major banks and traditional mortgage brokers.

5. TARGET MARKET

It is made for…

Property owners and new home buyers who are looking for a competitive home loan and a more enjoyable customer experience.

It is available for sale through…

Our platform, lendi.com.au.

Our marketing strategy is to…

Pay per click marketing, retargeting and print advertising (letterbox drops). We will also run promos and a referral program.

FINE PRINT: This SMART 100 profile and the information it contains is a duplication of content submitted by the applicant during the entry process. As a function of entry, applicants were required to declare that all details are factually correct, do not infringe on another’s intellectual property and are not unlawful, threatening, defamatory, invasive of privacy, obscene, or otherwise objectionable. Some profiles have been edited for reasons of space and clarity.

Maven Judge Vote: Lendi Customer Dashboard – Smart 100 2018

(Please note – The form below is for judging purposes only and is restricted to the public)

![Four Page Digital Marketing Strategy [FREE RESOURCE]](https://anthillonline.com/wp-content/uploads/2015/01/FOUR-PAGE-IMAGE-300x194.png)

![Instagram for Business… in 12 steps [FREE INFOGRAPHIC]](https://anthillonline.com/wp-content/uploads/2015/08/Capture7-100x75.jpg)

![Generating Web Traffic with Mark Middo and James Tuckerman [FREE REPORT]](https://anthillonline.com/wp-content/uploads/2015/08/Capture3-100x75.jpg)

![Three easy wins when using LinkedIn with David Hobson [FREE REPORT]](https://anthillonline.com/wp-content/uploads/2015/08/3quick-wins-100x75.png)

![The Ultimate Social Media Almanac with James Tuckerman [Cheat Sheet]](https://anthillonline.com/wp-content/uploads/2015/11/Screen-Shot-2015-11-26-at-11.24.55-100x75.png)

![The best seven Super Bowl ads for 2014 [VIDEO]](https://anthillonline.com/wp-content/uploads/2014/02/vw-wings-300x350.jpg)

![Seven essential steps to a successful podcast with Loren Bartley [Cheat Sheet]](https://anthillonline.com/wp-content/uploads/2015/11/Screen-Shot-2015-11-26-at-11.21.58-300x194.png)

![Strategic Alliances with Simone Novello [FREE INFOGRAPHIC]](https://anthillonline.com/wp-content/uploads/2015/08/Capture6-100x75.jpg)

![Five essential ingredients for a humming homepage with James Tuckerman [FREE REPORT]](https://anthillonline.com/wp-content/uploads/2015/07/homepage-checklist-1680-01-copy-100x75.png)

![New Zealand’s Xero eyes US IPO, further disruption as subscribers increase [INFOGRAPHIC]](https://anthillonline.com/wp-content/uploads/2014/07/sruuuuujana-212x194.png)

![Ever wonder if your ‘content marketing’ is really just crap? You gotta see this! [INFOGRAPHIC]](https://anthillonline.com/wp-content/uploads/2014/08/content-100x75.jpg)

![7 Business Lessons From Game of Thrones [INFOGRAPHIC]](https://anthillonline.com/wp-content/uploads/2014/10/infographic-games-of-thrones-041-100x75.jpg)

![How to build your own Media Empire… In seven steps with Nathan Chan [INFOGRAPHIC]](https://anthillonline.com/wp-content/uploads/2014/10/Nathan-Chan-Infographic-e1413419529176-100x75.jpg)

![5 Business Lessons From Tinder [INFOGRAPHIC]](https://anthillonline.com/wp-content/uploads/2014/10/Tinder-Elegant-Infographic-100x75.jpg)