Tag: IPO

Neobank Volt closes $70m oversubscribed Series C; hits $100m total funding and sets sights...

Australia's first neobank, Volt Bank Limited (Volt) has closed a $70m Series C equity funding round, which was oversubscribed by $10m beyond the original target of $60m.

Openpay launches shop now, pay later service; opens $8m-10m pre-IPO cap raise

Through its standalone software, customers use the Openpay app or the instore portal to make a purchase with payment transferred to the merchant the next business day, direct debited from the customer’s account.

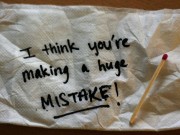

Don’t trip! 8 start-up mistakes every entrepreneur should watch out for

After reviewing over 9,000 business pitches in the 10 years and investing in more than 50 companies, VC Andrey Shirben shares 8 common entrepreneur mistakes

Listing on the ASX: should you use the front door or the back? Here’s...

As the Aussie sharemarket prepares for coming boom, companies preparing to list on the ASX need to consider whether to enter via the front door (IPO) or the back door (RTO).

Local services start-up Oneflare has raised $3 million and now set its sights on...

Australian local services marketplace, Oneflare recently completed a AU$3 million capital raising and has now signalled its intention to IPO.

A crowdsourcing company raised $363,000 pre-IPO funding through crowdfunding. All hail the crowd!

Australian equity-based crowdfunding platform, VentureCrowd recently raised $363,000 in a pre-IPO funding round for the popular crowdsourcing question–and–answer micro job network, Crowd Mobile.

Has the...

Ingogo raised another $9 million and is going places (not just in taxis)

Ingogo seemed to be the best thing to happen to Australian taxis since… the taxi. And with its recent announcement of an additional $9.1...

What’s next for Nad’s? No hairy business, but an IPO

Who knew that a simple act of mother’s love could turn into a multi-million dollar business? Sue Ismiel, CEO of Australian hair removal company...

Is private equity backing the key ingredient of a successful Australian IPO?

Are you looking to invest in Australian stocks?

If so, then this new study recently released by the Australian Private Equity & Venture Capital Association...

The real reason why Domenic Carosa’s Future Capital Development Fund has launched a pre-IPO...

This week, Domenic Carosa's Future Capital Development Fund (FCDFL), Australia's only internet-focused Pooled Development Fund, announced its plans to raise a new round of capital in the lead up to an IPO. It's current portfolio consists of approximately 15 companies, including MP3.com.au, which he bought back from Destra last year.

The real reason why Domenic Carosa's Future Capital Development Fund has launched a pre-IPO...

This week, Domenic Carosa's Future Capital Development Fund (FCDFL), Australia's only internet-focused Pooled Development Fund, announced its plans to raise a new round of capital in the lead up to an IPO. It's current portfolio consists of approximately 15 companies, including MP3.com.au, which he bought back from Destra last year.

Free ASX know-how forum to help small caps grow with IPO

The Australian Securities Exchange (ASX) announced today that it will be staging a free IPO workshop, on 16 February, for small cap companies (companies with a market capitalisation of between $300 million and $2 billion) interested in growing their business through public listing.

GoodBarry’s Bardia Housman shares his tips after selling to Adobe

Bardia Housman is an Australian entrepreneur who recently completed his second successful exit, selling Business Catalyst (makers of e-commerce software suite GoodBarry) to Adobe Systems. Australian specialist recruitment and M&A outfit MitchellLake captured this candid interview at the South Food+Wine Bar in San Francisco last month.

GoodBarry's Bardia Housman shares his tips after selling to Adobe

Bardia Housman is an Australian entrepreneur who recently completed his second successful exit, selling Business Catalyst (makers of e-commerce software suite GoodBarry) to Adobe Systems. Australian specialist recruitment and M&A outfit MitchellLake captured this candid interview at the South Food+Wine Bar in San Francisco last month.

Myer float a positive bellwether but will private equity investors be the only to...

The upcoming Myer float is largely being viewed as a positive sign for the Australian sharemarket. It is clearly a win for the Texas Pacific Group-led investors, who put up the money, and Bernie Brookes for delivering the rebirth. It could even be considered a win for the Myer family who could pocket $200 million. But despite the almost blanket glossy coverage, the effervescent smile of Jennifer Hawkins and the broader appeal of owning a small parcel of an Australian retail institution, I have my concerns.

How to get IPO ready

Listing on the stock exchange is a complex and expensive process, often consuming up to 10 percent of the funds raised, so it’s important to get it right.

Legal: Getting your business IPO ready

A thorough legal clean up of the company several months in advance of going to market removes the risk of having your dirty laundry...

Surf wars

The future of the information age is up for grabs and the darlings of the new, new economy are jostling for position. Since Google’s...

Putting the IP in your IPO

In the rollercoaster ride of potentially lucrative, but often disappointing, technology IPOs and private equity investments, a well-managed intellectual property portfolio could be your...

![Listing on the ASX: should you use the front door or the back? Here’s what the experts have to say [VIDEO]](https://anthillonline.com/wp-content/uploads/2015/05/ASX-180x135.jpg)

![Five ways to manage your time by managing yourself, with Helen Ebdon [CHEAT SHEET]](https://anthillonline.com/wp-content/uploads/2015/07/ebdon-3d-cover-01--300x194.png)

![Three easy wins when using LinkedIn with David Hobson [FREE REPORT]](https://anthillonline.com/wp-content/uploads/2015/08/3quick-wins-100x75.png)

![Ever considered crowdfunding? [FREE REPORT]](https://anthillonline.com/wp-content/uploads/2017/03/liz-wald-100x75.png)

![How to secure lucrative sponsorships in five steps [CHEAT SHEET]](https://anthillonline.com/wp-content/uploads/2016/02/jackie-fast-meme-04-100x75.jpg)

![Do you have happy staff? 5 ways to improve performance [FREE DOWNLOAD]](https://anthillonline.com/wp-content/uploads/2016/06/chris-smith-cheatsheet-04c.pdf-Box-2016-06-30-20-45-20-100x75.png)

![Seven essential steps to a successful podcast with Loren Bartley [Cheat Sheet]](https://anthillonline.com/wp-content/uploads/2015/11/Screen-Shot-2015-11-26-at-11.21.58-100x75.png)

![That startup show, episode two: Show me the money! [VIDEO]](https://anthillonline.com/wp-content/uploads/2014/11/ThatStartupShow-300x350.jpg)

![New, improved iPad Mini ad [VIDEO]](https://anthillonline.com/wp-content/uploads/2012/11/iPadMiniAd-300x322.jpg)

![5 Ways to get more out of your coffee shop meetings with Antony Gaddie [CHEAT SHEET]](https://anthillonline.com/wp-content/uploads/2015/07/gaddie-3d-cover-01--300x194.png)

![Need more leads? Here are five strategies [FREE DOWNLOAD]](https://anthillonline.com/wp-content/uploads/2016/04/james-FIVE-SIMPLE-STRATEGIES-TO-GET-MORE-LEADS-01-06.pdf-Box-2016-05-13-15-49-32-100x75.png)

![THE ULTIMATE CASHFLOW CHECKLIST [FREE DOWNLOAD]](https://anthillonline.com/wp-content/uploads/2016/06/james-Seven-simple-strategies-to-cut-costs-04.pdf-Box-2016-06-30-13-49-35-100x75.png)

![How to expand into New Markets with Elsita Meyer-Brandt [CHEAT SHEET]](https://anthillonline.com/wp-content/uploads/2015/07/Screen-Shot-2015-11-26-at-15.52.30-100x75.png)

![How To Grow Your Business and Profits with Jason Cunningham [CHEAT SHEET]](https://anthillonline.com/wp-content/uploads/2015/07/Cunningham-100x75.png)

![New Zealand’s Xero eyes US IPO, further disruption as subscribers increase [INFOGRAPHIC]](https://anthillonline.com/wp-content/uploads/2014/07/sruuuuujana-212x194.png)

![Ever wonder if your ‘content marketing’ is really just crap? You gotta see this! [INFOGRAPHIC]](https://anthillonline.com/wp-content/uploads/2014/08/content-100x75.jpg)

![7 Business Lessons From Game of Thrones [INFOGRAPHIC]](https://anthillonline.com/wp-content/uploads/2014/10/infographic-games-of-thrones-041-100x75.jpg)

![How to build your own Media Empire… In seven steps with Nathan Chan [INFOGRAPHIC]](https://anthillonline.com/wp-content/uploads/2014/10/Nathan-Chan-Infographic-e1413419529176-100x75.jpg)

![5 Business Lessons From Tinder [INFOGRAPHIC]](https://anthillonline.com/wp-content/uploads/2014/10/Tinder-Elegant-Infographic-100x75.jpg)